Overview of Resonac group Long-term vision

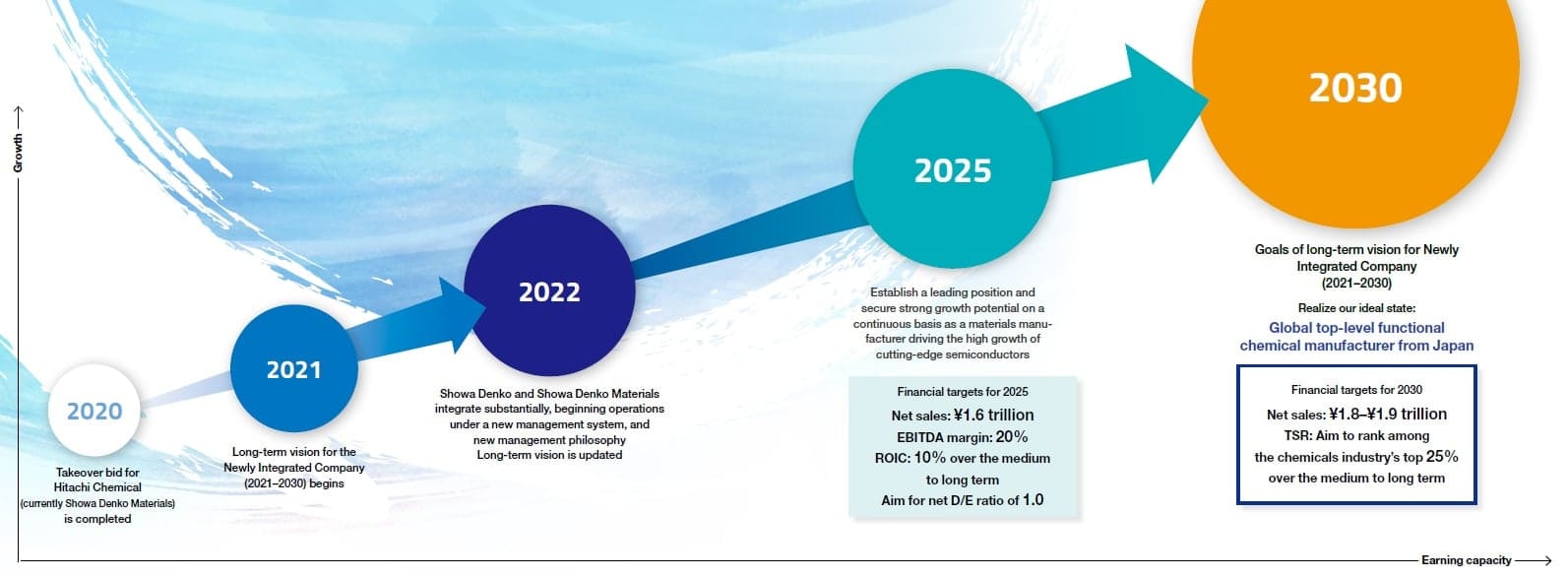

With the unification of the management systems of Showa Denko and Showa Denko Materials in January 2022, both companies have effectively realized their integration through a system in which management is executed by 12 corporate officers common to both companies, under the president and CEO. In conjunction with the launch of a new management system and the establishment of a new corporate philosophy, we also updated the long-term vision that we had announced in December 2020 and are moving forward with initiatives to achieve our ideal state in 2030.

Purpose (Our Aspiration)

Change society through the power of chemistry

Contribute to the sustainable development of global society by creating functions required of the times as an advanced material partner

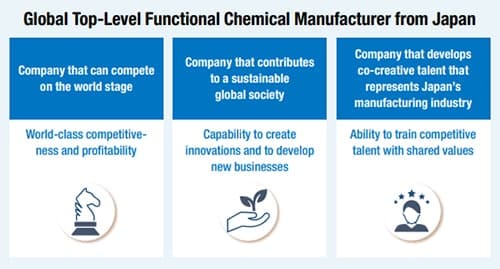

Ideal State

With the unification of the management systems of Showa Denko and Showa Denko Materials in January 2022, both companies have effectively realized their integration through a system in which management is executed by 12 corporate officers common to both companies, under the president and CEO. In conjunction with the launch of a new management system and the establishment of a new corporate philosophy, we also updated the long-term vision that we had announced in December 2020 and are moving forward with initiatives to achieve our ideal state in 2030.

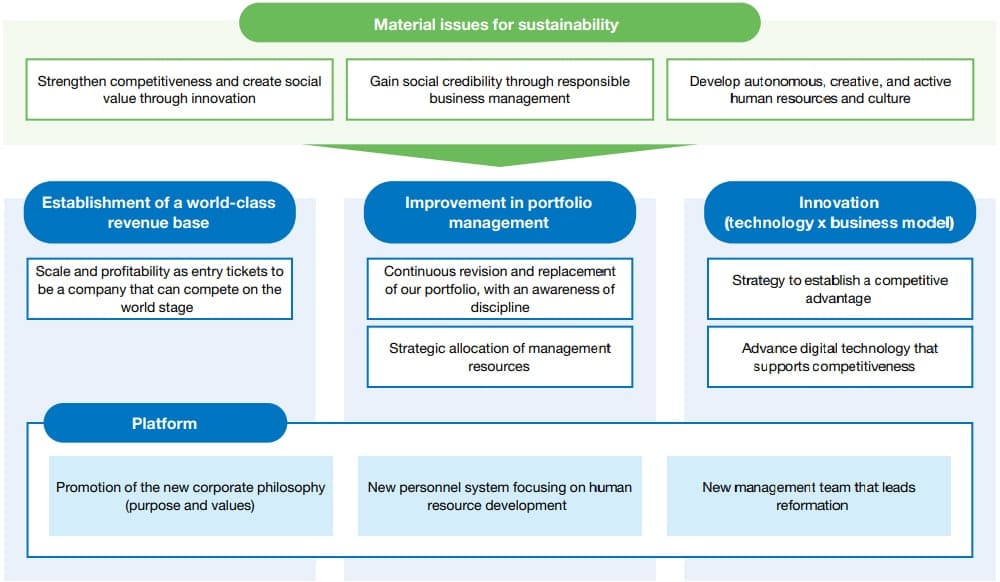

Main Strategies

Our long-term vision positions sustainability as an essential component of our Companywide strategies. Accordingly, we will establish a platform to become a global top-level functional chemical manufacturer and promote strategies incorporating our material issues for sustainability aimed at establishing a world-class revenue base, improving portfolio management, and spurring innovation.

Financial and Capital Strategies

Scale and Profitability as “Entry Tickets” to Be a Company That Can Compete on the World Stage

Resonac believes that strength in both quantitative and qualitative terms is essential to competing on the world stage. Quality means being able to contribute to society, and contributing in a sustainable manner is especially important. On the other hand, being strong in quantitative terms—that is, being a profitable company of a certain scale—is vital from the perspective of maximizing corporate value as well as from the perspective of contributing to society by implementing timely investments to secure earnings.

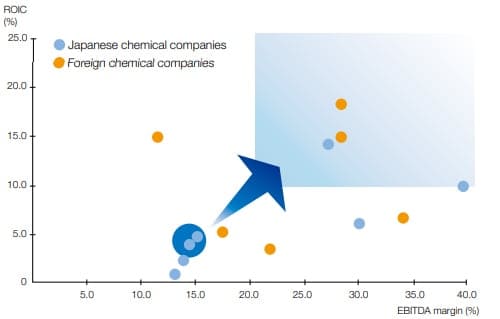

With regard to our long-term numerical targets, we aim to maximize corporate value by scrupulously achieving our numerical targets through the pursuit of scale and profitability to the tune of net sales of ¥1.6 trillion or more and an EBITDA margin of 20% or more as “entry tickets” to be a company that can compete on the world stage.

| 2021(results) | 2025(target)) | 2030(target) | |

|---|---|---|---|

| Net sales*(trillion yen) | 1.4 | 1.6 | 1.8~1.9 |

| EBITDA margin (%) | 14.3 | 20 | |

| ROIC(%) | 4.3 | 10% over the medium term | |

| Net D/E ratio (times) | 1.15 | Aim to achieve 1.0 | |

* Figures do not reflect the impact of future M&As.

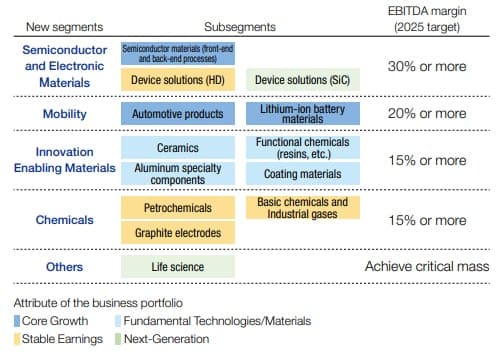

To more accurately highlight our strategic intent and our efforts to improve the management of our portfolio, we changed disclosure segments in December 2022. With the segment reclassifications, we will aim to more clearly show the effects of the strategic allocation of management resources and continuous revision and replacement of our business portfolio, of which the most obvious example is our focused investment on semiconductor materials.

Change to New Segments for Disclosure in Line with

the New Business Portfolio Strategy

Turning to our key performance indicators (KPIs), in a change from the KPI set forth in the long-term vision we announced in December 2020, we have introduced return on invested capital (ROIC) as a key numerical target from the perspective of emphasizing discipline.

We will promote awareness of ROIC-focused management among the heads of each business headquarters by measuring ROIC by each headquarters and the sub-business units that constitute the business headquarters and by ranking each sub-business unit by its ROIC components. In addition, we will instill ROIC-focused management and strive to improve portfolio management with the aim of achieving ROIC of 10% or more, by implementing both regular monitoring on a quarterly basis and a variety of measures, such as linking ROIC to management evaluations and bonuses.

Asset Efficiency and Profitability of Global Chemical Companies

Source: Prepared by Showa Denko based on financial

results and other disclosed materials.

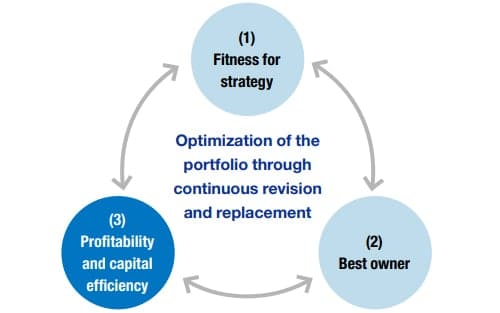

Improvement in Portfolio Management

Portfolio companies incessantly strive to improve their portfolios. Showa Denko strives to further improve its portfolio management by continuously revising and replacing its business portfolio. The Company has adopted three criteria as its portfolio management policy, as follows. (1) Fitness for strategy: Whether a business matches the strategies of the Company’s overall strategies and the strategies reflecting the roles of each business unit in accordance with the attributes of the portfolio, with sustainability as a prerequisite. (2) Best owner: Who the best management authority is to maximize the value of a business. (3) Profitability and capital efficiency: Whether a business or investment will satisfy expectations in terms of profitability and capital efficiency. Using these criteria as management guidelines, we focus on ROIC and seek to maximize corporate value.

Portfolio Management Policy

In its long-term vision, Showa Denko launched targets for selling ¥200 billion worth of businesses in terms of business value. Subsequently, the Company promptly made decisions on business sales, such as announcing the sale of its aluminum can, aluminum rolled product, food wrap film, printed wiring board, and energy storage device businesses. To date, we have achieved approximately 80% of our target. We are working to optimize the allocation of management resources and restructure our business portfolio to realize continuous growth and spur innovation through the integration of the technologies of Showa Denko and Showa Denko Materials. In proceeding with such efforts, we have carefully examined each of the businesses for sale and transferred them to the best owners, who can fully utilize the technological capabilities and strengths of such businesses, including solid relationships with customers, to facilitate their further development.

As for businesses that we will continue to operate, those connected to the semiconductor industry—a Core Growth business—will require large-scale investment given the likelihood of high market growth. With this in mind, we will raise investment funds on a Companywide basis by earning stable profits through Stable Earnings businesses such as petrochemicals and carbon.

As there is no end point to portfolio management, we will continuously examine business portfolio replacement to continue improving growth and profitability on an ongoing basis.

(Extract from Showa Denko Report 2022, Strategy.)